What are the hottest new and used financed models? Find out in the latest data from EDA and EquipmentWatch.

Quick Data is a snapshot of new and used construction equipment sales trends from Fusable’s EDA equipment financing data and EquipmentWatch market trend reports.

New financed bulldozer sales rebounded in 2024 following a dip in 2023, according to Fusable’s latest EDA equipment finance data.

Buyers financed 4,938 new bulldozers from December 1, 2023 to November 30, 2024, a 6.2% increase compared to the previous year.

Cat, Komatsu and Deere maintained their positions as the top three sellers of new finance bulldozers year-over-year, with Cat increasing its share by nearly 3 percent. The top-selling new models, based on the number of units financed, were:

- Cat D4 VP – 420

- Cat D5 VP – 367

- Cat D3 LGP – 355

- Deere 700L – 283

- Komatsu D51PXI-24 – 235

Texas had the most buyers of new finance bulldozers, with 832 units sold. Buyers were also active in Florida (386) and Georgia (370.)

Used finance bulldozer sales did not fare as well, with sales declining 4.5% to 7,799 units sold from December 1, 2023 to November 30, 2024.

Cat, Deere and Komatsu continued their sales dominance, holding the top three positions for used sales as well. The top-selling used models included:

- Cat D5K2 LGP – 220

- Cat D6N LGP – 216

- Deere 650K – 182

- Cat D6K2 LGP – 170

- Cat D8T – 139

Texas buyers again were in the top spot for those financing used machines, accounting for 1,078 units sold. Oklahoma added another 499 units; Mississippi followed with 476 units sold.

EDA data is compiled from state UCC-1 filings on financed construction equipment. EDA continually updates this data as information comes in from each state.

Used Bulldozer Sales

Used bulldozer prices increased during the 12-month period from December 1, 2023 to November 30, 2024, according to Fusable’s EquipmentWatch market trend data.

The average price tag for a used bulldozer was $234,126 in Q4 2023 compared to $267,739 in Q4 2024. The average age of used bulldozers decreased slightly during the period from 9.7 to 9.1 years. The average age and price were calculated based on 120,247 resale listings in the EquipmentWatch database during the period.

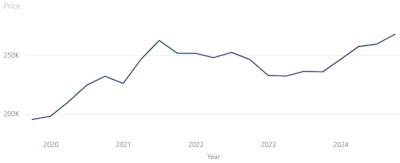

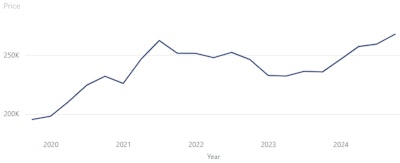

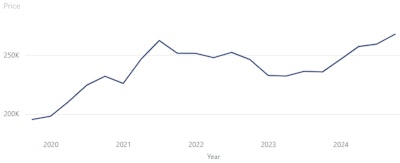

Over the last five years, average prices for used bulldozers have, in general, increased, with the fourth quarter of 2024 being the peak.

Average used bulldozer price over the last five years, according to EquipmentWatch market trend data.EquipmentWatch

Average used bulldozer price over the last five years, according to EquipmentWatch market trend data.EquipmentWatch

EquipmentWatch defines fair market value (FMV) as the monetary value of an asset that can be expected in a transaction with a single seller and single buyer, neither of whom is under any compulsion or time restriction to complete the transaction. FMV for heavy equipment is most closely associated with the private resale market, as opposed to the public auction market.

Fusable, the parent of Equipment World, owns EDA and EquipmentWatch.

Bulldozer Auction Sales in the U.S.

When examining the top 20 bulldozers sold for the 12-month period of December 1, 2023 to November 30, 2024, in terms of auction price, Cat dominated the charts, taking all 20 of the top 20 price spots.

According to the EquipmentWatch auction price guide, the top auction price paid for a motor grader during this time was $750,000 for a Cat D8T with 19 hours at an ATM Auctions sale in Monroe, North Carolina, on September 21, 2024.

EquipmentWatch does not include any units that sold for less than $5,000.

EDA and EquipmentWatch are owned by Fusable, the parent of Equipment World.

Quick Data is a snapshot of new and used construction equipment sales trends from Fusable’s EDA equipment financing data and EquipmentWatch market trend reports.

New financed bulldozer sales rebounded in 2024 following a dip in 2023, according to Fusable’s latest EDA equipment finance data.

Buyers financed 4,938 new bulldozers from December 1, 2023 to November 30, 2024, a 6.2% increase compared to the previous year.

Cat, Komatsu and Deere maintained their positions as the top three sellers of new finance bulldozers year-over-year, with Cat increasing its share by nearly 3 percent. The top-selling new models, based on the number of units financed, were:

- Cat D4 VP – 420

- Cat D5 VP – 367

- Cat D3 LGP – 355

- Deere 700L – 283

- Komatsu D51PXI-24 – 235

Texas had the most buyers of new finance bulldozers, with 832 units sold. Buyers were also active in Florida (386) and Georgia (370.)

Used finance bulldozer sales did not fare as well, with sales declining 4.5% to 7,799 units sold from December 1, 2023 to November 30, 2024.

Cat, Deere and Komatsu continued their sales dominance, holding the top three positions for used sales as well. The top-selling used models included:

- Cat D5K2 LGP – 220

- Cat D6N LGP – 216

- Deere 650K – 182

- Cat D6K2 LGP – 170

- Cat D8T – 139

Texas buyers again were in the top spot for those financing used machines, accounting for 1,078 units sold. Oklahoma added another 499 units; Mississippi followed with 476 units sold.

EDA data is compiled from state UCC-1 filings on financed construction equipment. EDA continually updates this data as information comes in from each state.

Used Bulldozer Sales

Used bulldozer prices increased during the 12-month period from December 1, 2023 to November 30, 2024, according to Fusable’s EquipmentWatch market trend data.

The average price tag for a used bulldozer was $234,126 in Q4 2023 compared to $267,739 in Q4 2024. The average age of used bulldozers decreased slightly during the period from 9.7 to 9.1 years. The average age and price were calculated based on 120,247 resale listings in the EquipmentWatch database during the period.

Over the last five years, average prices for used bulldozers have, in general, increased, with the fourth quarter of 2024 being the peak.

Average used bulldozer price over the last five years, according to EquipmentWatch market trend data.EquipmentWatch

Average used bulldozer price over the last five years, according to EquipmentWatch market trend data.EquipmentWatch

EquipmentWatch defines fair market value (FMV) as the monetary value of an asset that can be expected in a transaction with a single seller and single buyer, neither of whom is under any compulsion or time restriction to complete the transaction. FMV for heavy equipment is most closely associated with the private resale market, as opposed to the public auction market.

Fusable, the parent of Equipment World, owns EDA and EquipmentWatch.

Bulldozer Auction Sales in the U.S.

When examining the top 20 bulldozers sold for the 12-month period of December 1, 2023 to November 30, 2024, in terms of auction price, Cat dominated the charts, taking all 20 of the top 20 price spots.

According to the EquipmentWatch auction price guide, the top auction price paid for a motor grader during this time was $750,000 for a Cat D8T with 19 hours at an ATM Auctions sale in Monroe, North Carolina, on September 21, 2024.

EquipmentWatch does not include any units that sold for less than $5,000.

EDA and EquipmentWatch are owned by Fusable, the parent of Equipment World.