The post Understanding April 2025 Stamp Duty Changes & Impacts on the UK appeared first on UK Construction Blog.

If you’re planning to buy a home in England or Northern Ireland, the clock is ticking on higher Stamp Duty Land Tax (SDLT) costs. From 1st April 2025, major changes will take effect, meaning you could end up paying thousands more in tax if you don’t act quickly. The nil rate threshold is dropping, and first-time buyer relief is being tightened—so whether you’re a first-time buyer, a homeowner looking to move, or an investor, these changes will impact you.

Property transactions typically take 12 to 16 weeks. So if you want to buy a new home, complete the process before 31st March 2025 and take advantage of the current rates, now is the time to get moving. Here’s what you need to know.

Key Takeaways

- SDLT rates will increase for most property purchases, affecting affordability.

- The nil rate threshold will be reduced from £250,000 to £125,000.

- First-time buyer relief will apply to properties up to £300,000 instead of £425,000.

- If you are a buyer and want to avoid higher taxes, you need to start the process now and complete your purchase before 31st March 2025.

- Stamp duty hikes will raise rents through landlord cost pass-through, reducing rental supply and increasing competition amongst tenants.

- The impact will vary countrywide, with London and Southeast regions facing the greatest stamp duty impact, while northern areas experience milder effects.

- It is expected that there will be a surge in property transactions before April 2025, then decline for several months before stabilizing.

“If you don’t have the cash on hand for stamp duty and are planning to include it in your mortgage value – you could find yourself in a tough spot if you’re buying a property now and your transaction doesn’t complete before April.”

Luther Yeates, Head of Mortgages at UK Expat Mortgage

What is Stamp Duty Land Tax?

Stamp Duty Land Tax (SDLT) applies to property and land purchases in England and Northern Ireland. Buyers pay SDLT based on the purchase price, property type, and status. It covers residential, commercial, and leasehold transactions, each with different thresholds and rates. Buyers are required to pay the tax upon completing the property transaction.

You are required to pay Stamp Duty Land Tax (SDLT) when you:

- Purchase a freehold property

- Acquire a new or existing leasehold

- Buy a property through a shared ownership scheme

- Receive land or property in exchange for payment, such as taking on a mortgage or purchasing a share in a home

The Stamp Duty Land Tax (SDLT) amount is influenced by various factors including:

- The property’s purchase price

- Whether the buyer is a UK resident

- Whether the purchase is made as an individual or a company

- Whether the buyer is a first-time buyer, replacing their main residence, or acquiring an additional property

The government determines SLDT based on the price of a property or market value, whichever is higher. SLDT plays a role in stabilising the housing market by deterring property speculation.

Why is Stamp Duty Changing in April 2025?

In September 2022, the Conservative Government proposed a temporary change to support home ownership, making it easier to buy a home. Implementing an increase in the residential nil-rate threshold aimed to boost property transactions, meaning increased investment in housing and spending on durable goods.

The government announced in the 2024 Autumn Statement that the higher residential nil-rate threshold will expire on 31st March 2025. This means that any transaction completed thereafter will be subjected to the new SDLT rates starting April 1st, 2025.

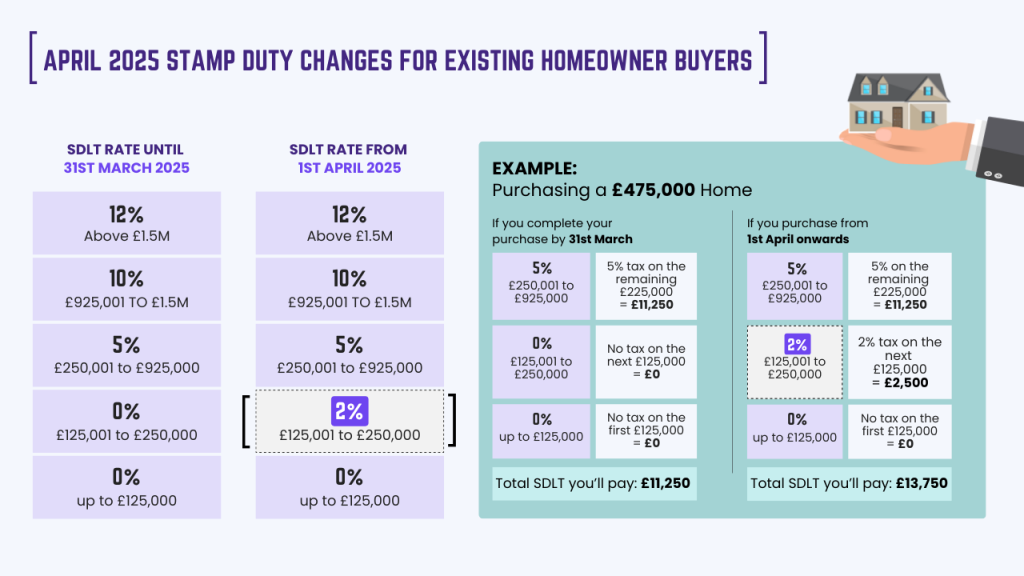

Stamp Duty Changes for Existing Homeowners

If you’re buying a single property that will be your main residence, and you don’t own another property, the value at which you’ll start to pay Stamp Duty is set to decrease from £250,000 to £125,000.

Current vs. New SDLT Rates

Stamp Duty Land Tax (SDLT) is based on a tiered system, where different portions of a property’s purchase price are taxed at specific rates. Rather than applying a single rate to the full price, only the amount within each band is taxed at the corresponding rate.

Current Stamp Duty tax rates up to 31st March, 2025

| Property Value Bracket | SLDT Rate for Main Residences until 31 March, 2025 |

| Up to £250,000 | 0% |

| The next £675,000 (From £250,001 to £925,000) |

5% |

| The next £575,000 (From £925,001 to £1.5 million) |

10% |

| The remaining amount (Above £1.5 million) |

12% |

New Stamp Duty tax rates starting 1 April, 2025

| Property Value Bracket | SDLT Rate for Main Residences From 1 April 2025 |

| Up to £125,000 | 0% |

| The next £125,000 (From £125,001 to £250,000) |

2% |

| The next £675,000 (From £250,001 to £925,000) |

5% |

| The next £575,000 (From £925,001 to £1.5 million) |

10% |

| The remaining amount (Above £1.5 million) |

12% |

Example: SDLT on a £250,000 Home

Buying Before 1 April 2025:

- You won’t pay any stamp duty on the first £250,000.

- Total SDLT you’ll pay: £0.

Buying On or After 1 April 2025:

- The first £125,000 is still tax-free.

- The next £125,000 (from £125,001 to £250,000) will now be taxed at 2%, which adds £2,500.

- Total SDLT you’ll pay: £2,500.

Stamp Duty Changes for First-Time Buyers

As a first-time buyer, you will face significant changes under the new system:

- The nil rate threshold will be lowered from £425,000 to £300,000.

- As a first-time buyer purchasing between £300,001 and £500,000, you will pay 5% SDLT on the excess.

- Properties above £500,000 will no longer qualify for first-time buyer relief and will be subject to the same tax as those who have bought a home previously.

Current vs. New SDLT Rates for First-Time Buyers

Current SDLT rates up to 31st March, 2025

| Property Value | SDLT rate up to 31 March, 2025 |

| Up to £300,000 | 0% |

| £300,001 – £425,000 | 0% |

| £425,001 – £500,000 | 5% |

| £500,001 – £625,000 | 5% |

| Above £625,000 | Standard Rates Apply |

New SDLT rates from 1st April, 2025

| Property Value | SDLT rate from 1 April, 2025 |

| Up to £300,000 | 0% |

| £300,001 – £425,000 | 5% |

| £425,001 – £500,000 | 5% |

| £500,001 – £625,000 | Standard Rates Apply |

| Above £625,000 | Standard Rates Apply |

Example: SDLT on a £475,000 Property for First-Time Buyers

Present – 31st March 2025 (Current Rules):

- No SDLT on the first £425,000

- 5% SDLT on the remaining £50,000 (£2,500)

- Total SDLT: £2,500

1st April 2025 onwards (New Rules):

- No SDLT on the first £300,000

- 5% SDLT on the remaining £175,000 (£8,750)

- Total SDLT: £8,750

What this means for you:

If you buy before 1 April 2025, you’ll pay just £2,500 in stamp duty. However, if you wait until after this date, your SDLT will more than triple to £8,750. This is because the tax-free threshold for first-time buyers will drop from £425,000 to £300,000, meaning a much larger portion of your property price will be taxed at 5%.

If you’re considering buying, acting before the deadline could save you £6,250 in stamp duty

As April 2025 approaches, property transactions and prices may see an uptick as buyers hurry to finalise purchases before the new stamp duty rates come into effect. However, this surge could be followed by a short-term slowdown once the changes take place. Lowering the 0% stamp duty threshold for first-time buyers from £425,000 to £300,000 may also put downward pressure on property prices within the £300,000 to £425,000 range, as buyers in this bracket will face higher costs.

“Mortgage approvals for first-time buyers will likely decrease. Not because lenders are unwilling to lend, but because first-time buyers will need to borrow more to cover the increased stamp duty costs. If first-time buyers need to borrow more, it will naturally affect their affordability.”

Rana Miah of IMC Mortgage Brokers

Higher Stamp Duty Rates for Additional Properties & Landlords

- The UK government raised the Stamp Duty Land Tax (SDLT) surcharge on additional residential properties from 3% to 5% above standard rates, effective October 31, 2024, immediately following the Autumn Budget. This impacts those purchasing second homes, buy-to-let investments, and holiday properties.

- Starting April 2025, an additional 2% charge will apply to the portion of property value between £125,000 and £250,000, further increasing the cost of these property transactions.

- While this may lower returns for buy-to-let investors, it could also ease competition in the market, potentially opening up opportunities for well-planned investments. [Quote on the impact of this 5% surcharge]

- If you are replacing your main residence, you will be exempt from the extra 5% surcharge if you sell your old home within 36 months.

| Property Value (£) | Rate up to 31 March 2025 | Rate 1 April 2025 onwards |

| Up to £125,000 | 5% | 5% |

| £125,001 to £250,000 | 5% | 7% |

| £250,001 to £925,000 | 10% | 10% |

| £925,001 to £1.5 million | 15% | 15% |

| Above £1.5 million | 17% | 17% |

Strategies for Landlords to Mitigate Increased Stamp Duty Costs

Landlords can implement several approaches to counter the impact of higher stamp duty expenses:

- Diversify Property Portfolios: Expand into more affordable housing markets in regions such as the Midlands or Northern England, where property values are typically lower.

- Focus on Value Properties: Target lower-priced properties to minimize overall tax liability, as stamp duty surcharges are calculated proportionally to property value.

- Consider Corporate Structures: Operating through a limited company may provide more advantageous tax treatment and potential deductions.

- Explore Holiday Lettings: Converting properties into furnished holiday lets can generate higher income and offer more favorable tax benefits, helping offset increased acquisition costs.

- Utilize Available Tax Reliefs: Investigate options such as Multiple Dwellings Relief when acquiring multiple properties in a single transaction.

- Negotiate Purchase Prices: For properties under negotiation, attempt to secure price reductions with sellers to distribute the burden of increased stamp duty.

- Purchase Off-Plan Properties: Buying during planning or construction phases often secures lower prices, subsequently reducing stamp duty liability.

- Adopt Long-Term Holding Strategies: Maintain properties for extended periods to spread initial stamp duty costs across years of rental income.

- Invest in Property Improvements: Enhance existing properties to boost rental yields and offset higher acquisition costs.

- Seek Specialized Advice: Consult tax specialists, financial advisors, and property management professionals to optimize investment approaches and effectively navigate tax changes.

These strategies can help landlords effectively manage the increased stamp duty costs while maintaining investment profitability.

Expected Impacts of SDLT Changes

How April 2025 Stamp Duty Changes May Increase UK Rental Prices

The upcoming stamp duty changes are expected to drive higher rental costs for tenants through several key mechanisms:

- Increased Landlord Acquisition Costs: The stamp duty surcharge on additional properties rising from 3% to 5% will significantly increase purchase costs for landlords. These higher expenses are likely to be transferred to tenants through rent increases.

- Diminishing Rental Property Supply: Higher stamp duty rates may discourage property investment, potentially reducing the available rental housing stock, particularly in high-demand areas. This contraction in supply could push rents upward.

- Worsening Supply-Demand Imbalance: With approximately 21 prospective tenants competing for each available rental property, the market already faces significant pressure. The stamp duty changes will likely intensify this imbalance, further driving up rental prices.

- Extended Property Holding Periods: Due to higher acquisition costs, landlords may choose to retain properties longer, reducing market turnover. This could restrict rental property availability and contribute to rent inflation.

- Cost Recovery Through Rents: As landlords absorb the increased financial burden from higher stamp duty rates, many will seek to recover these expenses by raising rents, especially in sought-after urban locations.

- Geographic Variation in Impact: Rental price increases may vary regionally, with areas having higher property values—such as London and the South East—potentially experiencing more substantial rent increases.

While the policy aims to improve homeownership accessibility, these changes may inadvertently create a more challenging rental market characterized by reduced options and higher costs for tenants.

“Any increase in cost to a landlord will naturally be passed on to tenants via rent. Being a landlord is a business like any other. The pressure being applied to the private rental sector by regulatory and tax changes is not good for tenants. The industry saw this coming from afar and issued warnings to that effect, but unfortunately they appear to have been overlooked.”

Nicola Eaton, Marketing Director of specialist mortgage broker, Commercial Trust.

Expected Impact of April 2025 UK Stamp Duty Changes on Property Transactions

The 2025 UK stamp duty changes are predicted to create several distinct patterns in property transaction volumes:

- Pre-April 2025 Transaction Surge: A notable increase in property transactions is expected in Q1 2025, particularly in March, as buyers accelerate purchases to complete before the new stamp duty rates take effect on April 1, 2025.

- Post-Implementation Slowdown: Once the new rates are implemented, transaction volumes are likely to weaken for approximately three to six months following April 2025.

- Moderated Market Fluctuations: While transaction volumes will fluctuate, these swings are expected to be less extreme than with previous stamp duty changes, as the current reduction has been in place for some time and its planned expiration was widely anticipated.

- First-Time Buyer Activity Shifts: The reduction of the stamp duty threshold for first-time buyers from £425,000 to £300,000 may trigger a rush of first-time buyer transactions before April 2025, followed by a potential decline afterward.

- Eventual Market Stabilization: Following the initial surge and subsequent decline, transaction activity is expected to normalize. Over 67% of letting agents anticipate a market correction once the deadline passes.

While these stamp duty changes will influence transaction patterns, other factors including interest rates, mortgage availability, and broader economic conditions will also significantly shape the UK property market throughout 2025 and beyond.

Impact of April 2025 Stamp Duty Changes on UK Property Prices

The 2025 stamp duty modifications are projected to influence UK property prices in several ways:

- Price Adjustments Near Thresholds: Some downward pressure on property values may occur, particularly for homes priced just above the new thresholds. Sellers might need to reduce asking prices to compensate for buyers’ increased stamp duty costs.

- Geographic Price Disparities: Effects will likely vary regionally. London and the South East, with their higher average house prices, may experience more significant impacts as more properties exceed the new thresholds.

- First-Time Buyer Segment Softening: The reduction of the 0% stamp duty threshold for first-time buyers from £425,000 to £300,000 could weaken prices for properties in the £300,000-£425,000 range as these buyers face higher transaction costs.

- Investment Property Market Cooling: The stamp duty surcharge increase from 3% to 5% for additional properties may dampen the buy-to-let market, potentially reducing prices for typical investment properties.

- Pre-Implementation Price Volatility: Before April 2025, a transaction surge may temporarily boost prices as buyers rush to complete purchases under current rates, followed by a possible post-implementation dip in both activity and prices.

- Gradual Market Stabilization: Following initial adjustments, the market should normalize, though with potentially moderated price growth, especially for properties just above the new thresholds.

While these stamp duty changes will influence the market, other factors including interest rates, broader economic conditions, and housing supply will remain significant determinants of overall property price trends.

“Demand may dip in the short term as buyers adjust to the increased costs, but long-term demand should remain stable.”

Carl Shave, Director and Mortgage Adviser from Just Mortgage Brokers,

Regional Impact on First-Time buyers of April 2025 Stamp Duty Changes

Regional Impact on Existing Homeowners of April 2025 Stamp Duty Changes

Regional Impact of April 2025 Stamp Duty Changes Across the UK

The upcoming stamp duty changes in April 2025 will have varying effects across different UK regions, with southern areas facing the most significant impact:

- London: The capital will be most severely affected, with 97% of property transactions expected to incur stamp duty following the changes. London’s exceptionally high property values mean nearly all purchases will exceed the new thresholds.

- South East: This region faces similar challenges to London, with 95% of transactions projected to become stamp duty liable after April 2025, reflecting the area’s high average house prices.

- Eastern England: A dramatic increase is expected here, with properties subject to stamp duty rising substantially from 73% to 95% of all transactions.

- South West: This region will experience a considerable shift, with stamp duty liability jumping from 49% to 90% of property sales.

- West Midlands: This area will see the most dramatic percentage increase in stamp duty obligations, with a 66% surge in affected transactions.

- East Midlands: Close behind the West Midlands, this region faces a 55% increase in stamp duty liability.

Regions with lower average property prices will be comparatively less affected:

- North East: While still impacted, this region will see the smallest proportion of transactions liable for stamp duty, rising from 7% to 40%.

- Northern Ireland: The impact will be relatively moderate, with stamp duty liability increasing from 10% to 59% of transactions.

- North West and Yorkshire and the Humber: These northern regions will also experience increases, though significantly less pronounced than in southern England.

How to Prepare for the SDLT Changes

- Budget for Higher Costs

- Carefully calculate the new SDLT rates when planning your property purchase to avoid unexpected financial burdens.

- Time Your Purchase

- Consider finalising your purchase before 31st March 2025 to take advantage of the current SDLT rates and potentially save thousands.

- Seek Expert Advice

- Consult with property professionals to understand how these changes affect your specific situation.

- Stay Updated

- Keep track of any further government announcements or amendments to the SDLT rules to ensure you’re fully prepared.

These changes represent a major shift in the property tax system. If you’re planning to buy a property in 2025 or beyond, factor these new rates into your budget and seek professional guidance to make well-informed decisions.

Conclusion

The upcoming SDLT changes will significantly impact property buyers, making homes more expensive due to increased tax liabilities. First-time buyers, in particular, will need to budget for higher SDLT costs. If you’re planning to buy a home, considering completing your purchase before March 2025 could result in substantial savings.

For precise SDLT calculations, use the Stamp Duty calculator to determine the tax you’ll owe based on your circumstances.